Ethereum reports: ETH ETH trips are kept with a collection of $ 370 million

Context:

Ethereum is the most important of 2. Crypto after bitcoins in terms of market capitalization. Funded funds (ETF) in cash on Ethereum were listed in the United States in 2024.

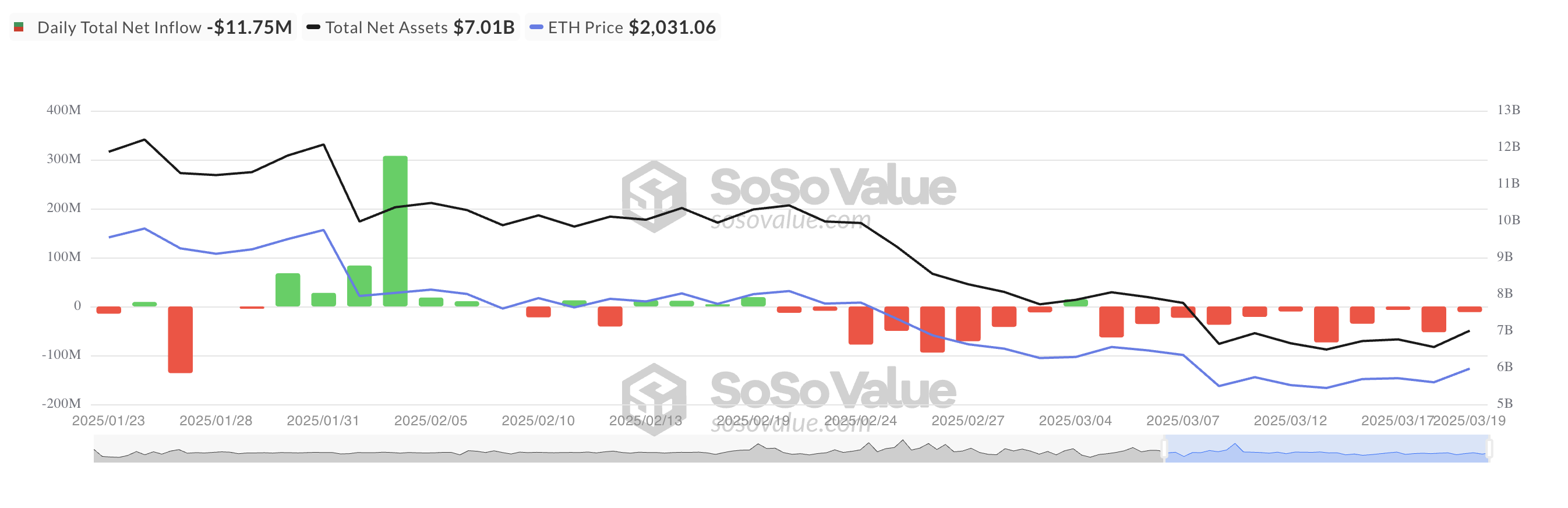

This long -term decline in the price of ETH has sagged the confidence of investors in Altcoin in sectors 1 in this industry, resulting in regular outflows of capital negotiated funds (ETF) to ETH since the beginning of March.

Ethereum Ethers takes significant funds

According to SOSVAVALUE data on the chain, ETH ETH has now recorded 11 consecutive days of trips, with total withdrawals exceeding $ 370 million.

Ethereum’s feeling of investors remained extremely down, with a single day this month. The total net value of the assets of all ETH ETH in US cash is currently $ 7.01 billion and has been diving 44 %since the beginning of the year.

When the ETFE SURTEREUM experiences clean trips, investors receive more funds than they bring, and therefore reflects reducing confidence in the performance of the ETH price. Supported trips are indicators in the size of the reduction of investors and can intensify the pressure on the Ethereum.

In addition, the decline in open interest (OI) of part reflects the application for a decline. At the time of writing this article, this indicator is $ 6.58 billion, which is 20 %last month.

We remind you that the open interest in the asset measures the total number of derivative contracts in circulation, such as future (or term contracts) and options that have not been resolved. As it decreases, it suggests that traders close positions rather than open new ones.

This suggests reduced participation in the Ethereum market and weakening of dynamics for the course of ETH. This situation indicates the uncertainty and lack of beliefs about the direction of Altcoin course, which contributes to its decline.

The Golden Cross, which will strengthen the course?

In connection with the renewal of the entire crypto market in recent days, the gliding average convergence (MACD) has created an ETH Gold Cross diagram or the Golden Cross. In fact, the MacD line is now above the signal line (orange) in the daily chart, the bull pressure gradually includes its momentum.

The MACD indicator measures the strength and direction of asset dynamics and helps traders identify the potential reversal of trend and dynamic change. Thus, when a golden cross appears, it points to an increase in dynamics up, often interpreted traders as a purchase signal.

If the purchasing pressure is strengthened, ETH can eventually reverse its current trend down and climb $ 2,224.

Conversely, if the course drop persists, Ethereum could drop below $ 2,000, with potential stabilization to $ 1,924.

Morality History: When Etfe Etereum dictates tone, traders are bored.

Notification of irresponsibility

Notice of irresponsibility: In accordance with the Trust project Directives, this article for price analysis is intended only for information purposes and must not be considered financial or investment advice. Beincrypto undertakes to provide accurate and impartial information, but market conditions may change without prior notice. Always carry out your own research before making any financial decision and consult a professional.

Post Comment